Launch a New Career in Tech

Become a Metallica Scholar!

This fall, CCV is pleased to offer the IT and Cyber Careers Scholarship, supporting students on the path to a rewarding, high-demand career.

Launch a New Career in Tech

This fall, CCV is pleased to offer the IT and Cyber Careers Scholarship, supporting students on the path to a rewarding, high-demand career.

In partnership with Metallica’s Foundation, All Within My Hands, and the American Association of Community Colleges, this scholarship is available to CCV students pursuing the IT support or cybersecurity & networking certificate.

Students enrolled in at least 6 credits for Fall 2024 and Spring 2025 semester can receive up to $2,000, or $1,000 per semester.

With a certificate in IT or cybersecurity, you’ll be well equipped to join one of Vermont’s most exciting, high-demand careers. Almost every company needs skilled IT professionals, so you’ll be qualified to work in a variety of industries, from healthcare to manufacturing to education. Both certificates can be completed in just one year of full-time study, and both can be completed fully online. As a student at CCV, you’ll enjoy small classes, personalized support from faculty and staff, and flexible scheduling so you can fit college into your busy life.

The Vermont Guarantee is a partnership agreement between the Community College of Vermont and participating colleges and universities in the state. Students interested in transferring to a participating institution can now take advantage of this option for a seamless transfer of credits.

*Must meet all eligibility criteria for the selected college and capacity is available within the intended major.

GPA for Eligibility: 2.0

Transfer Web Page: Champlain College – Vermont Transfer Guarantee

Guarantee Transfer Coordinator: Leah Miller (802-551-1958)

Financial Aid and/or Scholarships: Financial aid and scholarships and grants are available to transfer students.

Net Price Calculator: champlain.edu/admissions/undergraduate-admissions/financial-aid-undergraduate/tuition-and-cost-of-attendance/net-price-calculator

Institution Size: 2,000 undergraduates

Transfer Policies:

GPA for Eligibility: 2.0

Transfer Web Page: Norwich University – Vermont Transfer Guarantee

Guarantee Transfer Coordinator: Krystal Aleman (802-485-2001)

Financial Aid and/or Scholarships: Financial aid is available to transfer students.

Net Price Calculator: home.norwich.edu/on/admissions-aid/financial-aid/cost-calculator

Transfer Policies:

GPA for Eligibility: 2.0

Transfer Web Page: Transfer – CCV Students

Guarantee Transfer Coordinator: Maurice Ouimet, Jr. (888-398-8878)

Financial Aid and/or Scholarships: Core academic performance is used to determine scholarship eligibility and level. Transfer applicants will be evaluated based on their prior coursework and corresponding GPA. Candidates who have earned 18 credits or less need to have also completed a rigorous, college preparatory high school curriculum as determined by Vermont State Admissions. More scholarship information can be found here.

Net Price Calculator: vermontstate.edu/admission/tuition-and-fees/

Institution Size: 4,500 undergraduates

Transfer Policies:

GPA for Eligibility: 2.0

Transfer Web Page: Champlain College Online – Vermont Transfer Guarantee

Guarantee Transfer Coordinator: Sarah McMaster (802-357-5188)

Financial Aid and/or Scholarships: Financial aid and scholarships and information on paying for college are available to transfer students.

Net Price Calculator: champlain.clearcostcalculator.com/student/default/netpricecalculator/survey

Transfer Policies:

GPA for Eligibility: 2.5

Transfer Web Page: Transfer Students

Guarantee Transfer Coordinator: Marnie Owen (802-654-2571)

Transfer Admissions Coordinator: Logan Lanfear

Financial Aid and/or Scholarships: Financial aid and scholarships and grants are available to transfer students.

Net Price Calculator: smcvt.edu/admission-aid/financial-aid/net-price-calculator/

Transfer Policies:

GPA for Eligibility: 2.0

Transfer Web Page: Sterling College Vermont Transfer Guarantee

Guarantee Transfer Coordinator: Weylin Garnett (802-586-7711, ext. 106)

Financial Aid and/or Scholarships: sterlingcollege.edu/scholarships

Net Price Calculator: sterlingcollege.edu/financial-aid

Transfer Policies:

Please note: Transfer Pathways will show you bachelor’s degree program options to partner institutions after completing your associate degree under the VT Guarantee. 2+2 Pathways are articulated program maps from certain CCV programs to transfer partner bachelor’s degrees. 2+2 Pathways show you how the courses you take count and guarantee just 60 more credits after earning an associate degree at CCV.

If you or your family have circumstances that weren’t accounted for on your financial aid forms, we encourage you to reach out to your Financial Aid Counselor to see if a revision to your financial aid eligibility is possible.

The 2024/2025 FAFSA® results are based on your current assets and 2022 family income. However, sometimes family circumstances can change significantly and the U.S. Department of Education allows institutions to make adjustments to elements of a student’s FAFSA on a case-by-case basis. Circumstances may include a loss of income, a change in the number of people in the household, unusually high medical expenses not covered by insurance, or other significant changes. The Change in Family Financial Circumstances Appeal forms can be found on the Financial Aid Forms page.

Answers to questions on FAFSA determine whether a student is considered dependent or independent for financial aid purposes. The federal student aid programs are based on the concept that it is primarily the student and their family’s responsibility to pay for the student’s education. A dependent student is assumed to have the support of parents, so the parents’ information must be assessed, along with the student’s, in order to get a full picture of the family’s financial strength.

There may be extraordinary circumstances that warrant students who do not meet the definition of independent to appeal their dependency status. Examples of extraordinary circumstances that could warrant dependency override may include: Parent(s) being incarcerated, abandonment by parent(s), an abusive or dangerous family environment or other clear manifestations of complete distancing of a student from their parent(s). Circumstances that do not warrant dependency override may include: Self-sufficiency (living on your own, paying your own bills), parent(s) who are unwilling to provide information or sign the FAFSA, parent(s) who are unwilling or unable to provide financial assistance for college, or parent(s) who no longer claim you as a dependent for income tax purposes The Dependency Override Appeal form can be found on the Financial Aid Forms page.

New for the 2024/2025 academic year, dependent students who do not provide parental information on the FAFSA will still be able to complete the application. The application will be provisionally processed as independent and the student will receive an estimated/provisional Student Aid Index (SAI) and show estimated eligibility for federal grants and loans. This does not guarantee that the student will be granted independent status for federal financial aid purposes. CCV will contact students for which we receive a provisional independent status via email within 30 days. Students will be asked to complete the Dependency Override Appeal to explain their circumstances. If the Dependency Override Appeal is approved, CCV will carry that decision forward to future award years without collecting documentation unless the student contacts CCV and indicates their circumstances have changed. The Dependency Override Appeal form can be found on the Financial Aid Forms page.

If you decide to drop or withdraw from a course or all of your courses during a semester, please contact your Financial Aid Counselor prior to your drop or withdrawal.

Federal financial aid is offered to students based on the expectation that they will attend their courses for the entire semester.

When a student who has received, or is otherwise eligible for, federal funds has withdrawn from a semester, CCV is required by law to perform a Return of Title IV Funds (R2T4) calculation to determine the percentage and amount of aid that the student earned up to the time of withdrawal. The outcome of an R2T4 calculation may result in CCV’s determination that a student owes funds to the college, the federal government, or both. The R2T4 calculation is separate from CCV’s Add/Drop and Refund policy.

Federal law requires CCV to calculate how much federal financial aid a student has earned if that student:

Or if a student is enrolled in Accelerated courses or courses that do not span the entire semester and that student:

A student’s withdrawal date is determined in the following order:

The full Attendance Policy can be found on CCV’s policies and procedures page.

Any “unearned” aid must be returned to the federal Government in the following order:

The full Financial Aid Policy can be found on CCV’s policies and procedures page.

When you’re on the hunt for the perfect job, the tools matter. You need access to comprehensive job listings, salary information, skill assessment resources, and a whole host of support systems to make sure the job you land is the job you planned for. Our tools are designed to help you accomplish that goal. You’ll find in-depth information about career fields, resources to help you identify your interests and strengths, and even tools to help you understand how much money you’ll need to make to support the lifestyle you want. Sign up, explore, and move forward. Your future job is waiting.

Focus2 can help you discover jobs you didn’t know existed and start setting goals. Included are detailed self-assessments, comprehensive career information, exploration matched to CCV’s programs, and career readiness and planning resources. Create a new account by clicking the Register button at the bottom of the login page (ACCESS CODE: ccvcareerservices) or log in to review your saved information.

Looking for some quick advice from business professionals on a wide range of career topics? Check out our suite of career advice videos.

CareerSpot offers advice videos on:

Find your path to a rewarding, high-demand career. Career Coach helps you identify your interests using career assessment, explore CCV programs, and search for job opportunities that include relevant data on wages, employment, and the training you’ll need.

Build relationships with employers on Handshake. Students can find jobs & internships, connect with recruiters, attend virtual information sessions, and more! Activate your account today using your CCV.edu credentials (username and password). Create a profile, get personalized job recommendations, and find the right job for you.

Parker Dewey can help you gain experience in your field and get paid with micro-internships. These short-term professional projects allow you to build your skills (and your resume), work remotely around your schedule, and network with both local and national companies. Create a free account today to start searching – new opportunities are posted daily.

Acces the Career Services guides to learn more about interview skills, cover letters and resumes, networking and more! These tools are available to students, alumni, faculty and staff, and employers.

The workforce training needs of your company or organization are unique. Sometimes the solutions that have worked for your partners or your competitors will work for you, and sometimes they won’t. This is where standardized approaches to workforce development come up short. Partnering with CCV is different. We work with you to develop and implement customized strategies designed specifically for your needs and targeted to take your employees and your business to the next level.

CCV’s statewide presence, strong online learning capability, and dedication to flexible educational delivery gives us the ability to design workshops, trainings, and programs that meet the needs of your employees when and where you need them. With delivery at one of our CCV locations or at your place of business during hours that best fit your schedule, we can increase the skill base of your workforce from entry-level through management. We will work together to create a plan based on your specific training needs. Courses can be designed as half-day, full-day, or week-long trainings to meet your needs.

Past Customized Trainings have included:

The Career Pathway Entry Program at CCV is an on-ramp for career seekers to explore industries, participate in job shadowns with local employers, gain college credit and an industry credential, and earn cash while they learn.

As the second-largest college in the state, CCV has a student body large enough to meet the needs of your business. Our statewide presence means that no matter where you’re located, there are CCV students ready to gain experience and help your business thrive. CCV’s online job and internship recruiting site, Handshake, gives you access to hundreds of potential employees in Vermont and beyond.

As an employer, using Handshake gives you the ability to:

CCV’s corporate voucher program allows companies to purchase seats in bulk for any of our 3-credit courses at a discounted rate. With CCV, your tuition assistance dollars go further and benefit more employees.

Offering tuition assistance is a proven strategy to retain your workforce, reduce recruitment costs, enhance operational effectiveness, close skill gaps, increase equity, and build a stronger company.

CCV offers many industry-recognized credentials such as:

Many of your employees may have college credit already, and many will have completed college-level learning through jobs and other life experiences. CCV’s Prior Learning Assessment programs are designed to award college credit to individuals based on the level of college-level learning they’ve attained. Read about how Comcast provided its employees the opportunity to earn college credits through CCV’s PLA program. Multiple options are available and courses can be offered on-site or at any CCV location.

If you already have training and educational programming in place for your employees, our Education and Training Evaluation Service (ETES) could be a good option to enhance those programs. In conjunction with the Vermont State Colleges’ Office of External Programs, CCV’s Prior Learning Assessment Office can evaluate your training systems for college-level equivalency. A successful ETES evaluation will allow employees who complete your training program to receive college credits for their work.

Prior Learning Assessment Office

802-828-4064

priorlearning@ccv.edu

When you’re on the hunt for the perfect job, the tools matter. You need access to comprehensive job listings, salary information, skill assessment resources, and a whole host of support systems to make sure the job you land is the job you planned for. Our tools and dedicated team are here to help you accomplish that goal. You’ll find in-depth information about career fields, resources to help you identify your interests and strengths, and even tools to help you understand how much money you’ll need to make to support the lifestyle you want. We encourage you to explore, connect, and keep moving forward. Your future job is waiting.

CCV’s Career Services team provides students and alumni with a range of personalized services. We’re here to help you explore careers, craft an academic career plan, embark on a job search, and more.

Students can work with Career Services to explore opportunities, identify your interests and skills, and understand how CCV programs can prepare you for your chosen career.

Our tools provide in-depth information about career fields, job listings, salary information, and resources to help you identify your interests and strengths. Students can access self-assessments, in-depth career information, and comprehensive planning resources.

Sign up, explore, and move forward. Your future job is waiting.

CCV’s education programs prepare you to teach at a variety of levels. The early childhood education degree program provides the knowledge and skills you’ll need to enter a rewarding, high-demand career in child care. The liberal studies degree is a solid foundation for the education you’ll need to become an elementary, middle, or high school teacher. Credentials and certificate programs can lead to employment as a home child care provider, after school program provider, or early childhood education administrator. Whatever path you choose, you’ll be well positioned for the workforce or further education.

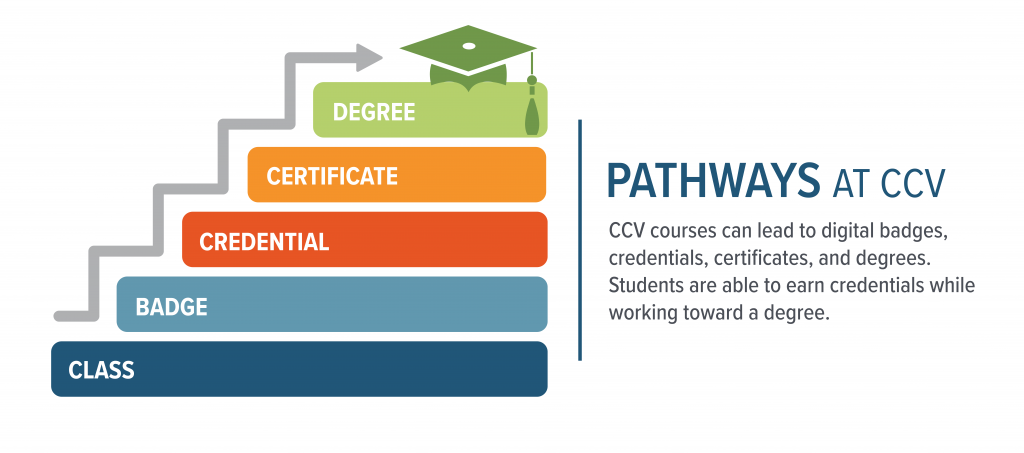

CCV programs are stackable, meaning they build on one another as you progress toward your goals. Individual classes can be applied to credentials, credentials to certificates, and certificates to degrees. Check out our certificate to degree maps and explore the stackable program options available to you.

Degrees

Certificates

Credentials

Programs marked with “+” can be completed fully online.

Did you know that nearly half of CCV graduates choose to continue their education beyond an associate degree? To make transfer seamless, easy, and affordable, CCV has agreements with other institutions across Vermont and throughout the region. Early planning can help you follow a clear transfer path.

In today’s workplace, industry-recognized credentials carry earning power. At CCV, we offer credentialing and training opportunities at our locations around the state and online. These programs have been designed from the ground up with input from Vermont employers on the skills and knowledge they’d like to see workers equipped with. Get credentialed, get trained, get your next promotion.

Credential and Training Benefits:

Visit our online catalog for complete and comprehensive program and course information.

Jean graduated from CCV in 2018 with her associate degree in early childhood education and became the director of childcare for Jay Peak Resort in 2019. “I climbed the career ladder because of the degree,” she said. “It completely changed how I looked at childcare. It used to be ‘I’m providing a home for children.’ Now it’s about education.”

If you want to continue your education after CCV, we want to help you get there. We’re excited to introduce our new transfer pathways search tool, which you can use to quickly find the right pathway for you. Explore transfer options by CCV programs or degrees, search by transfer partners, or look up a specific program by name. View VT Guarantee partners and eligible programs below and visit VT Transfer Guarantee for more information.

Please note: Transfer Pathways will show you bachelor’s degree program options to partner institutions after completing your associate degree. 2+2 Pathways are articulated program maps from certain CCV programs to transfer partner bachelor’s degrees. 2+2 Pathways show you how the courses you take count and guarantee just 60 more credits after earning an associate degree at CCV.

Your benefits aren’t the only options available to you to help cover college expenses. Scholarships specifically for veteran and military-connected are available from organizations and foundations from around the world. The following list is by no means comprehensive, and as we hear about new scholarships or changes to existing ones, we’ll make updates here. In the meantime, if you know of a scholarship we’ve missed, please contact us.

| Full Time | 3/4 Time | 1/2 Time | 1/4 Time | |

|---|---|---|---|---|

| Fall/Spring | 12+ credits | 9 – 11 credits | *6 – 8 credits | 3 – 5 credits |

| Summer | 9+ credits | 7 – 8 credits | 5 – 6 credits | 3 – 4 credits |

*Chapter 33, Post 9/11 GI Bill students enrolled in 6 or less credits in Fall/Spring will only receive funds for the cost of tuition and fees.

Prior to starting at CCV, you must supply the CCV Registrar’s Office with official copies of your military transcript and transcripts from any other colleges you’ve attended.

“GI Bill®” is a registered trademark of the U.S. Department of Veterans Affairs (VA). More information about education benefits offered by VA is available at the official U.S. government web site at http://www.benefits.va.gov/gibill.

Apply today or contact us with any questions.