- CCV Financial Aid General Call Line – 802-262-6557

- CCV Financial Aid General Text Line – 802-613-0031

- CCV Financial Aid General Email – financialaid@ccv.edu

- Bennington – Stephanie Kinney – Call: 802-447-6947

- Brattleboro – Michele Hastings – Call: 802-281-5224

- Center for Online Learning – Stephanie Kinney – Call: 802-447-6947

- Middlebury – Kirstin Richardson – Call: 802-527-5421

- Montpelier – Nikki Fraser – Call: 802-828-0131

- Morrisville – Tina Prescott – Call: 802-748-6673

- Newport – Eliza Walters – Call: 802-334-4452

- Rutland – See general call, text, email information

- Springfield – Michele Hastings – Call: 802-281-5224

- St. Albans – Kirstin Richardson – Call: 802-527-5421

- St. Johnsbury – Tina Prescott – Call: 802-748-6673

- Upper Valley – Michele Hastings – Call: 802-281-5224

- Winooski – Ali Herman – Call: 802-654-0969

Winooski – Sheryl Eddy – Call: 802-654-0522

High School Student

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- March 2017

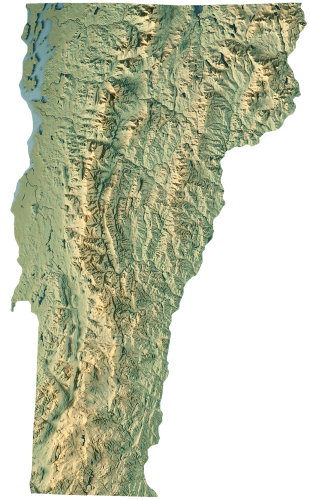

Find Our Locations

- Bennington: 802-447-2361

- Brattleboro: 802-254-6370

- Middlebury: 802-388-3032

- Montpelier: 802-828-4060

- Morrisville: 802-888-4258

- Newport: 802-334-3387

- Rutland: 802-786-6996

- Springfield: 802-885-8360

- St. Albans: 802-524-6541

- St. Johnsbury: 802-748-6673

- Upper Valley: 802-295-8822

- Winooski: 802-654-0505

Move your cursor or click on the maple leaves to learn more about our centers and what they have to offer.

With twelve locations and the Center for Online Learning, you don’t have to travel far from your community to access our degree and certificate programs, workforce, secondary and continuing education opportunities, and academic and veteran support services. Community College of Vermont — we are where you are.

Learn more about our academic center locations and faculty, find staff, and contact us for questions about the College, including media inquiries.

Administrative Offices

Most of CCV’s administrative offices are concentrated in our CCV-Montpelier and CCV-Winooski academic centers. A few can be found at centers throughout the state. Please consult the listing below to find the office you are looking for.

Learn More

Academic Center Locations

CCV is located within 25 miles of nearly every Vermont household. With twelve academic centers and a Center for Online Learning, you don’t have to travel far to access our programs and support services.

Learn More

Center for Online Learning

The Center for Online Learning offers hundreds of courses each semester in subject areas that include art & design, computer information systems, biology, allied health, and a wide variety of courses in the humanities and social sciences.

Learn More

Media Inquiries

CCV is happy to field any media inquiries regarding the College, its faculty, or its students. If you’re a member of the media looking for information about the College, begin your research here.

Learn More

Contact Us

Learn More

Faculty

Each semester CCV employs over 400 instructors to teach courses throughout the state and online. And one of the strongest aspects of your CCV education is derived from the access you’ll have to our faculty.

Learn MoreCCV is an accredited, open-admissions college, offering a wide range of courses during fall, spring, and summer semesters at twelve academic centers and online. Classes are highly interactive, with students of all ages and backgrounds, offering you the opportunity to become part of our vibrant, engaged learning community.

CCV offers associate degree programs leading to associate of arts (A.A.) and associate of science (A.S.) degrees. We also offer 22 certificates. Our programs provide the knowledge you need for employment or further study at the bachelor’s level.

Degrees, Certificates & Other Programs

Whatever your interests and goals, there are CCV programs available to match them – you choose the path.

Learn More

Credentials & Training

CCV offers credentialing and training opportunities at our locations around the state and online.

Learn More

Registered Apprenticeships

Businesses across Vermont hire apprentices in a variety of industries. CCV offers the educational component of registered apprenticeships in these occupations: certified public bookkeeping, medical assisting, medical records specialist, pharmacy technician, and manufacturing production technician.

Learn More

Credit for What You Know

At CCV, we provide convenient options to request credit for college-level learning and experience gained through work and training, military or community service, and online or individual study.

Learn More

Classes

CCV classes are vigorous and engaging, full of discussion and active learning. Students explore subjects in depth, guided by instructors who live in the community and are experts in their fields.

Learn More

Experiential Learning

Experiential learning activities like service learning, study abroad, and internships prepare CCV students for real-life success.

Learn More

Transfer from CCV

CCV has agreements with other institutions in Vermont and the region to make transferring seamless, easy, and affordable.

Learn More

Academic Calendar

CCV’s Academic Calendar includes important semester dates and holiday closures.

Learn More

Academic & Career Support Services

CCV is here to support you. Discover academic resources that will help you be successful in college.

Learn MoreEach CCV academic center offers part-time work-study positions where you can contribute as a member of the academic staff. Hourly wages are $16.00. You must be enrolled in at least six credits of a degree program and have financial need. Contact your Financial Aid Counselor to see if you are eligible.

Learn more about the Federal Work-Study (FWS) Program.

View current openings here.

Student loans can be used to pay for a variety of costs associated with your college education, such as tuition and fees, room and board, books and supplies, transportation, and the purchase of a computer or software. However, while borrowing funds may be a wise investment, it deserves careful consideration; all student loans must be paid back, including interest and fees. Before deciding to take out a loan, be sure to look for free money first, such as grants and scholarships, and speak to a CCV Financial Aid Counselor about other funding options. If you meet eligibility requirements you can submit a Federal Loan request here (CCV login required).

Types of Federal Loans

Federal Direct Loans are available to students who qualify for federal financial aid and are enrolled in at least six credits per semester. If you decide to borrow, there are two types of Federal Direct Loans: subsidized and unsubsidized. Eligible parents of dependent students can also take out Direct Parent PLUS loans.

Federal Subsidized Direct Loans

These loans are available based on your demonstrated financial need, determined by information provided on your FAFSA®. The federal government will pay the interest on a subsidized loan while you are in school and completing your program successfully. There are limits on how much you can borrow based on your year in school.

Federal Unsubsidized Direct Loans

Unsubsidized direct loans are available for students who don’t demonstrate financial need. You are responsible for all interest that accrues on the loan. You may choose to make interest payments while in school or defer interest payments, which will then be added to the principal of the loan. There are limits on how much you can borrow based on your year in school.

Federal Parent PLUS Loans

PLUS loans enable parents with good credit histories to borrow money to help pay for their child’s college expenses. The student must be enrolled at least half-time in a degree program. Parents can borrow up to the student’s full cost of education less other types of financial aid. If your family is interested in borrowing a Parent PLUS loan, please contact your Financial Aid Counselor.

Loan Exit Counseling

If you are leaving or graduating from CCV and you have borrowed a Federal Direct Loan, you are required to complete Loan Exit Counseling. Click here for exit counseling.

Steps to Apply for a Loan

You must be enrolled in at least six credits required for your degree or certificate program and have completed a FAFSA. You can also follow these steps:

- Complete BOTH the Master Promissory Note and Loan Entrance Counseling for Subsidized/ Unsubsidized loan type at studentaid.gov.

- After completing the Master Promissory Note and Entrance Counseling, contact your Financial Aid Counselor to determine the amount you need to cover your tuition, fees, books, and other qualified expenses.

- Once the semester begins, go to class! Attendance in six credits is needed to maintain eligibility for your loan.

Frequently Asked Questions

What is the interest rate?

Interest rates are typically fixed for federal student loans, and change depending on when your loan was taken out. The federal government maintains an ongoing chart of interest rates.

What is a Loan Servicer?

A loan servicer is a company that handles the billing and other services on your federal student loan. The loan servicer will work with you on repayment plans and loan consolidation and will assist you with other tasks related to your federal student loan. It is important to maintain contact with your loan servicer. If your circumstances change at any time during your repayment period, your loan servicer will be able to help.

Who is my Loan Servicer?

Login to studentaid.gov to find the name of your federal loan servicer as well as your complete financial aid history.

How much is my monthly payment going to be?

You can get exact estimates of your monthly payments or plan for the future by adding in anticipated student loans by using the Repayment Estimator on studentaid.gov.

What happens when I’m having difficulty repaying my loan?

There’s help available. It is important to ask for help as soon as making timely payments becomes an issue. The best thing to do is to work with your loan servicer to discuss options, which may include forbearance, consolidation, or a modified payment plan. There is also information on repayment and avoiding and resolving defaulted loans at studentaid.gov. CCV financial aid counselors can also answer your questions.

What if I have an issue with my loan servicer?

If you are unable to clarify or resolve a federal student loan issue, the Department of Education offers an ombudsman service available at studentaid.gov/feedback-ombudsman/disputes/prepare.

What repayment options are available?

There are several options that can change your repayment schedule, suspend, or reduce your payments. Eligibility varies depending upon the option you pursue. Please contact your student loan servicer to discuss repayment options in more detail.

Federal Pell Grants

Students who have not received a bachelor’s degree may be eligible for this federal grant program. The amount of the award will depend on your Student Aid Index resulting from the FAFSA® and enrollment status.

Federal Supplemental Educational Opportunity Grant (FSEOG)

SEOG is awarded by the College to students with high financial need. The amount of the SEOG award will depend on your financial need and enrollment status. CCV has limited SEOG funds.

Vermont Incentive Grant

VSAC awards this grant to Vermont residents enrolled full- or part-time in degree programs based on financial need and enrollment status. There is no specific deadline, but it is always best to apply early before funds run out. For more information, visit the VSAC website.

802 Opportunity

VSAC awards this grant to Vermont residents enrolled full or part-time in degree programs based on financial need. The 802 Opportunity offers free tuition for Vermonters with a family income of $100,000 or less, who do not already have a bachelor’s degree, and who meet eligibility requirements for federal financial aid. For more information, visit ccv.edu/802.

Advancement Grant

This grant is awarded by VSAC to Vermont residents enrolled in a continuing education program based on financial need to help with tuition and fee costs. Awards are given on a first-come, first-served basis. For more information, visit the VSAC website.

It is your responsibility to:

- Review and consider all information about the school’s program before you enroll.

- Complete all application forms accurately and submit them on time. Errors can result in long delays in your receipt of financial aid. Intentional misreporting of information on application forms for federal financial aid is in violation of the law and is considered a criminal offense subject to penalties under U.S. Criminal Code.

- File the Free Application for Federal Student Aid (FAFSA) online for the fastest processing of your application. You can also submit a paper FAFSA. In either case, you will receive a FAFSA Submission Summary.

- If your FAFSA needs corrections, you may make them online or consult with your Financial Aid Counselor.

- Return all additional documentation, verification, corrections and/or new information to the financial aid office.

- Read and understand all forms that you are asked to sign and keep copies of them.

- Accept responsibility for all agreements you sign.

- Notify CCV of change in address, name, or any other information which may affect our ability to contact you. If you have a loan, notify the lender of changes in your name, address, or school enrollment status.

- Perform the work that is agreed upon in accepting a Federal Work-Study award.

- Know and comply with the deadlines for application or reapplication for aid. You must apply again each year.

- Know and comply with CCV’s refund procedures.

- Be familiar with the consequences of dropping a class, withdrawing from a class, and not making satisfactory academic progress.

- Attend class! If you never attend classes or stop attending before your financial aid application process is completed, you may not receive aid, grants, or loans to pay your balance due to the CCV. If you stop attending before the end of the term, your aid may be reduced or canceled. In either case you may owe a balance due to the CCV.

- If you are a loan recipient and your enrollment falls below 6 credits, you are graduating from CCV, or you are leaving CCV, complete Loan Exit Counseling.

- Seek resolution of complaints regarding the award of financial aid at CCV through procedures as outlined in the Complaint Resolution for Students policy.

All financial aid information supplied to the Community College of Vermont by a student, or in support of the student’s application, will be held in strict confidence and will be used by the Financial Aid Officer only to determine the amount and type of award for which the student may be eligible.

- Free Application for Federal Student Aid (FAFSA) – CCV’s school code is 011167

- Financial Aid Advance to Purchase Textbooks Form (FAAPT) – CCV login required

- Federal Loan Request Form – CCV login required

Verification

After completing your FAFSA® the U.S. Department of Education may select your application for verification. If you are selected for verification, CCV is required to collect information to confirm that the information you provided on the FAFSA is accurate. CCV will contact you if you need to complete any additional forms. CCV may not be able to offer you financial aid if any required additional forms are not submitted.

2025 – 2026 Forms

(Fall 2025, Spring 2026, and Summer 2026 semesters)

Electronic Forms (RECOMMENDED)

- 25-26 Independent Family Size

- 25-26 Dependent Family Size

- 25-26 Student Tax Submission

- 25-26 Student Non-Tax Filer

- 25-26 Parent Tax Submission

- 25-26 Appeal – Change in financial circumstances – Independent

- 25-26 Dependency Override Appeal

- 25-26 Financial Aid Document Uploader

- 25-26 Federal Loan Request Form

Paper Forms

- 25-26 Dependent Family Size

- 25-26 Independent Family Size

- 25-26 Parent Tax Non-Filer Statement Form

- 25-26 Student Tax Non-Filer Statement Form

- 25-26 Spouse Tax Non-Filer Statement Form

- 25-26 Tax Filer Instructions

- 25-26 High School Completion Status

- 25-26 Appeal – Change in financial circumstances – Dependent

- 25-26 Appeal – Change in financial circumstances – Independent

- 25-26 Verification of Independent Status

- 25-26 Dependency Override Appeal

Satisfactory Academic Progress (SAP) Form – Electronic (RECOMMENDED)

Satisfactory Academic Progress (SAP) Form – PDF

CCV’s financial aid counselors are here to help you throughout the process – from application to graduation. Contact the FA counselor at your nearest center with questions, or for help with applying for financial aid. You may also submit the contact form below.

All financial aid programs have specific eligibility requirements, application forms, and deadlines. When you receive financial aid, you have the responsibility to make sure you are doing everything you can to retain your eligibility. Complete information about financial aid is available in the Student Handbook, or from a Financial Aid Counselor.

General Eligibility Requirements for Federal Financial Aid

- You must have demonstrated financial need for need-based federal student aid programs.

- You must be a U.S. Citizen or eligible non-citizen.

- You must have a valid Social Security number (Except students from the Republic of the Marshall Islands, Federated States of Micronesia, or the Republic of Palau).

- You must be enrolled in a degree or certificate program at CCV.

- You must have a high school diploma, GED, or have completed a home school program.

- You must be enrolled in at least 6 credits except for the federal Pell Grant program.

- You must not be in default on federal student loans or owe a refund on previously awarded financial aid.

- You must provide consent and approval to have your federal tax information transferred directly into your 2024–25 Free Application for Federal Student Aid (FAFSA®) form.

- You must maintain satisfactory academic progress.

Federal financial aid can only pay for courses that meet degree or certificate completion requirements.

The Higher Education Opportunity Act conditions the eligibility of educational institutions to participate in Title IV programs on the development of and compliance with a code of conduct prohibiting conflicts of interest for its financial aid personnel [HEOA § 487(a)(25)]. CCV’s officers, employees, and agents are required to comply with this code of conduct. The following specific provisions bring CCV into compliance with the federal law [HEOA § 487(e)].

- Neither CCV as an institution nor any individual officer, employee, or agent shall enter into any revenue-sharing arrangements with any lender.

- No officer or employee of CCV who is employed in student financial services or who otherwise has responsibilities with respect to education loans, or agent who has responsibilities with respect to education loans, or any of their family members, shall solicit or accept any gift from a lender, guarantor, or servicer of education loans. For purposes of this prohibition, the term “gift” means any gratuity, favor, discount, entertainment, hospitality, loan, or other item having a monetary value of more than a de minimis amount.

- An officer or employee of CCV who is employed in Financial Aid or who otherwise has responsibilities with respect to education loans, or an agent who has responsibilities with respect to education loans, shall not accept from any lender or affiliate of any lender any fee, payment, or other financial benefit (including the opportunity to purchase stock) as compensation for any type of consulting arrangement or other contract to provide services to a lender or on behalf of a lender relating to education loans.

- CCV shall not:

- for any first-time borrower, assign, through award packaging or other methods, the borrower’s loan to a particular lender other than Direct Loans;

- refuse to certify, or delay certification of, any loan based on the borrower’s selection of a particular lender or guaranty agency.

- CCV shall not request or accept from any lender any offer of funds to be used for private education loans, including funds for an opportunity pool loan, to students in exchange for the institution providing concessions or promises regarding providing the lender with:

- a specified number of loans made, insured, or guaranteed under Title IV;

- a specified loan volume of such loans; or

- a preferred lender arrangement for such loans.

- CCV shall not request or accept from any lender any assistance with call center staffing or Financial Aid staffing.

Any employee who is employed in Financial Aid, or who otherwise has responsibilities with respect to education loans or other student financial aid, and who serves on an advisory board, commission, or group established by a lender, guarantor, or group of lenders or guarantors, shall be prohibited from receiving anything of value from the lender, guarantor, or group of lenders or guarantors, except that the employee may be reimbursed for reasonable expenses incurred in serving on such advisory board, commission, or group.

Introduction to College & Careers

CCV offers a free, non-credit Introduction to College & Careers (ICC) course for high school students each semester. ICC prepares you for college by helping you set goals, problem-solve, manage time and stress, improve communication skills, take better notes, reduce test anxiety, and plan financially. To enroll in this class as a new CCV student, apply online and select a specific ICC course section. The skills assessment is not required, as it will be completed during the class.

Want more information about ICC? Visit gotocollegevt.org.

Vermont’s Dual Enrollment Program

Vermont’s Dual Enrollment program offers Vermont high school juniors and seniors the opportunity to earn up to six college credits at CCV. That means your credits help you finish high school and start college, all at the same time!

Talk with your high school guidance counselor about applying your college credits toward your high school credit requirement. Students under the age of 16 need special permission to enroll at CCV. Contact your local CCV academic center for information.

After you apply for admission, we will review your application and contact you to explain your specific next steps. In the meantime, we recommend you do the following:

- Apply for a Vermont Dual Enrollment voucher.

- Schedule a New Student Appointment with an academic advisor to discuss your goals and specific steps for enrolling. Contact your preferred CCV academic center to schedule this meeting.

- Complete your skills assessment. This assessment is used to help you select the classes most appropriate to your academic skills and is offered, by appointment, at all CCV locations. Official SAT or ACT scores that are less than three years old may be submitted for review instead.

- Browse our course schedule for classes you are interested in taking. You should discuss your possible choices with your high school guidance counselor to see if you can earn high school credits for your college class.

Fast Forward Program for Technical Center Students

The Fast Forward program helps students in technical center programs earn college credit while they are still in high school and prepares them to enroll in college degree programs. Students earn credit toward their technical center program and college credit at the same time. The courses are taught at the tech center, and students must meet enrollment requirements for specific courses.

The credits earned in these courses are accepted by CCV toward degree requirements in program areas like allied health, business, early childhood education, graphic design, and information technology.

To become a Fast Forward Student:

- Apply for admission.

- If you have not already completed the skills assessment, contact your tech center counselor to take it as soon as possible.

- Contact your tech center counselor to sign up for a Fast Forward course.

Go to http://fastforward.vsc.edu/ for more information or contact fastforward@ccv.edu if you have questions.

Early College

If you are a rising Vermont high school senior, CCV’s Early College program allows you to spend your entire senior year at CCV earning college credits, finishing your high school diploma, and getting a jump on your college degree, tuition-free! (Students are responsible for all textbook costs and applicable fees.) Students in this program enroll full-time at any of CCV’s 12 academic centers.

Download our Early College Information Sheet to learn more about the program.

To become an Early College student:

- Apply for Early College admission by the following deadlines: Priority – May 1; Final – August 6, 2025. This step must be completed by all Early College applicants, including current Dual Enrollment, Intro to College & Careers, and Fast Forward students. The Early College application includes the following checklist items:

- the Educator Recommendation form, completed by your school counselor, teacher, CCV advisor, or CCV faculty who has worked with you academically and can speak to your abilities (parents/guardians/family members may not complete this form)

- the Graduation Requirements form, completed by your high school counselor, or your parent/guardian/program supervisor if you are a home study student

- the Principal Assurance form, requested by the individual completing the Graduation Requirements form and completed by your high school principal, or your parent/guardian/program supervisor if you are a home study student

- official copies of all high school transcripts (submitted to CCV directly by your school), and

- your responses to short answer questions. These can be entered after submitting the application on your status page. Each question requires a brief response, and together, they help us understand your readiness for Early College.

- Complete the Accuplacer assessment (or submit official score reports for SAT or ACT assessments meeting college benchmarks).

Soon after your completed application is received, you will be contacted regarding your status in the Early College program. If accepted, you will then work with your school counselor and CCV advisor to enroll full-time in college courses.

Students must apply and be ready to enroll in full-time, college-level coursework. Contact Brianna Madden, CCV Admissions Specialist (brianna.madden@ccv.edu, 802-334-3388) for more information.